Sounds great, right? Just put good data in and get good prices back.

But that’s not how it works.

Yes, I have to take a mulligan here. Our screen printing pricing spreadsheet? It’s fine. It can definitely get you started. But it’s not the whole story – and it’s probably the wrong thing to focus on when you start talking about your prices.

In other words: a spreadsheet isn’t how to set your prices. You need to think about your entire business.

Cost Volume Profit Analysis In Screen Printing

That became super clear when Bruce and Steven grabbed their latest guest to talk pricing. Nick Gawreluk is an MBA business student that literally wrote his thesis on print shop pricing. The kicker? It’s not exactly complicated, but it isn’t easy either.

Set a goal that makes sense, start chipping away at it, and see if you can beat it. Do simple math. Keep things strategic.

But how is that a pricing strategy? We’ll explain – the podcast is worth a listen (or ten), by the way. You can safely throw away your spreadsheet when you’re armed with this knowledge.

“This strategy can be an easy way to take control of your business and visually understand what’s going on – and then put a strategy to work toward that goal.”

Screen Printing Pricing: A Better Model

Pricing your work can be as complex or as simple as you want. But there are several things that get tangled up when people talk about pricing. Let me explain. There are actually three things that people discuss when they’re discussing pricing, and they’re often discussing all of them at the same time:

- Setting the right price. This is setting the price that the market will bear. If you can charge $65 for that Taylor Swift merch, hey, you should. This is about understanding consumer psychology, your niche, your market, and your competition.

- Creating a pricing strategy. This is not the same as setting a price. A pricing strategy does not say what your prices should be, it determines how you’re setting your prices. For example, your prices for t-shirts may require a different strategy than pricing for high-end leather embroidery.

- Pricing for profitability. Here’s the final piece of the puzzle: knowing how much profit you’ll make from the prices you’re charging. This is where traditional accounting often breaks down, since it’s a lagging indicator: you don’t know if you were profitable this month until next month!

If we’re talking about setting the right price, we should discuss the specific customer niche that you serve.

If we’re talking about creating a pricing strategy, we should discuss the nature of your business and its fixed costs.

If we’re talking about pricing for profitability, then we need to dive into your finances and understand how jobs are moving through your business.

This newsletter will discuss creating a pricing strategy for your business and pricing for profitability – and it’s powerful.

What are fixed costs in a print shop?

The first step: take all of your fixed costs and put them into one “bucket.”

Fixed costs are things you have to pay for and know you have to pay for. It’s everything you really need to run your business.

These costs stay the same because you always need to spend on these items to keep doing business. This includes a lot of things like:

- Insurance

- Leases and mortgages

- Salaries and payroll

- Utilities

- Various printing materials: ink, emulsion, etc.*

- Software

- A minimum profit you want to make

*Remember: though the amount of ink and other consumables may change month over month, it isn’t a variable cost. It’s fixed. You have to pay for these items to continue doing business.

What are variable costs in a print shop?

Variable costs are things that vary depending on what you’re doing. The simplest way to define variable costs in a screen printing setting is to make the item you’re printing on the sole source of variable costs.

This is what Steven Farag at Campus Ink does: if they’re selling t-shirts, then the t-shirts are the only variable cost.

Yes, this simplifies things, and some people want to capture every single aspect of screen printing that “fluctuates”.

But those aren’t really variable costs. They are a fixed cost because you have to spend that money this month, next month, and every month after that – even if those costs change slightly month-over-month.

Using Fixed Costs To Set Goals In Print Shops

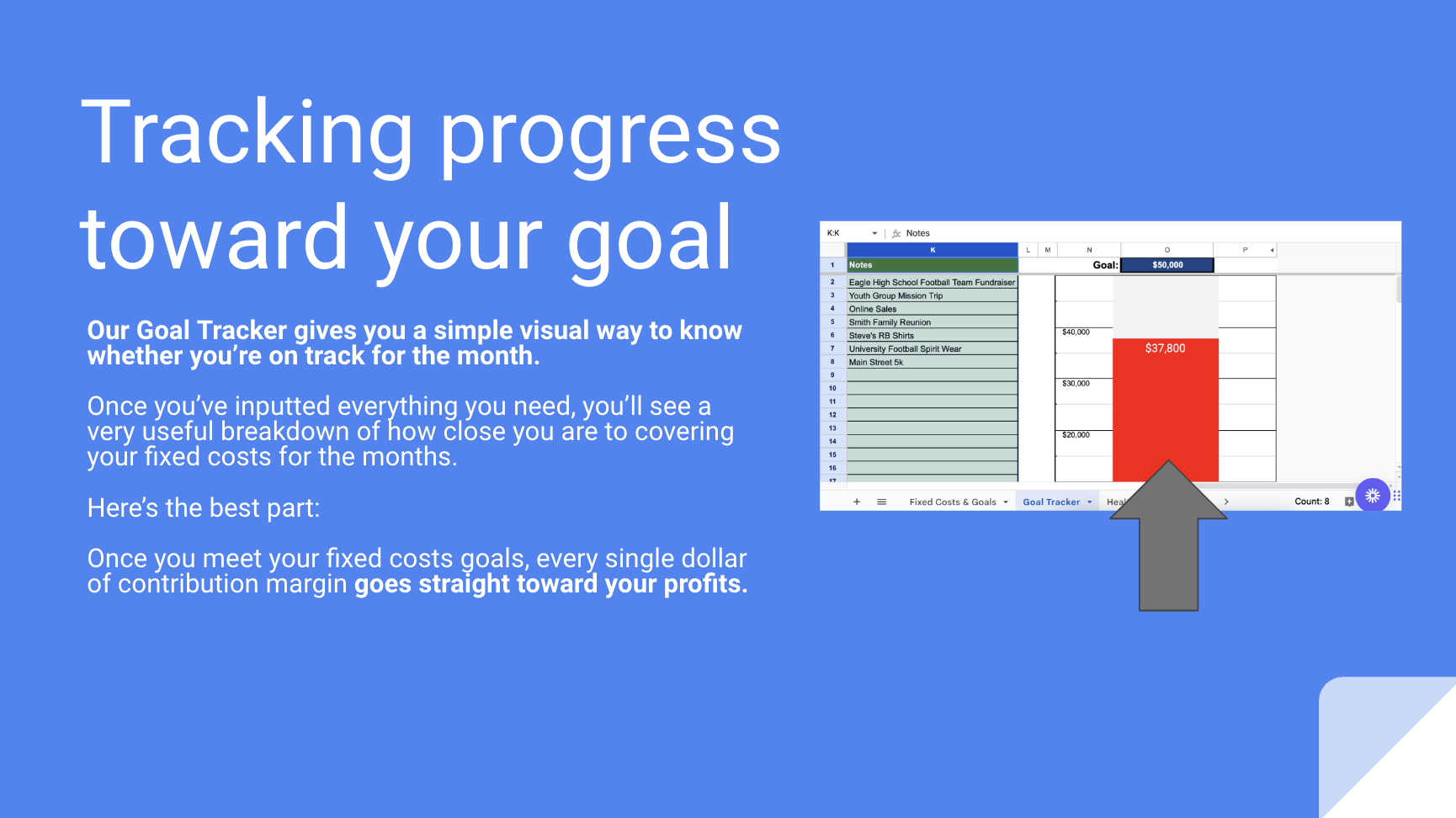

Let’s say your shop has monthly fixed costs (everything you need to run your shop from labor to rent to supplies) of about $50,000.

You add some profit, some owner’s compensation, and a little bit of wiggle room and say that your fixed costs are really $70,000 per month.

That means $70,000 is your “mountain to climb” every month. You have to make $70,000 in sales to meet your fixed costs.

Since there are roughly 20 working days in each month, you have to make $3,500 in sales each day to cover those fixed costs.

Once you hit working day 15 and you’ve made $70,000 in sales, every single sale past that point goes straight to the bottom line.

This way, you always know where you stand during each month – and can prioritize your work accordingly each and every day.

Why is this so powerful? Because it lets you do two things:

- Understand which jobs are really covering your fixed costs and which jobs are making you the most profit

- Know when you can and can’t make exceptions on prices

You can go a step further and understand how each job is contributing to that goal of covering your fixed costs with the contribution margin.

“If you know on the 20th of the month that you’ve covered your fixed costs, then maybe a customer that’s looking for the cheapest price comes to you and you do the job – but before you wouldn’t have entertained it. If you know where you stand in the month for your business, you can make that call. That’s a fundamental difference between an accountant telling you that you were profitable last month. You know then and there if you were profitable.”

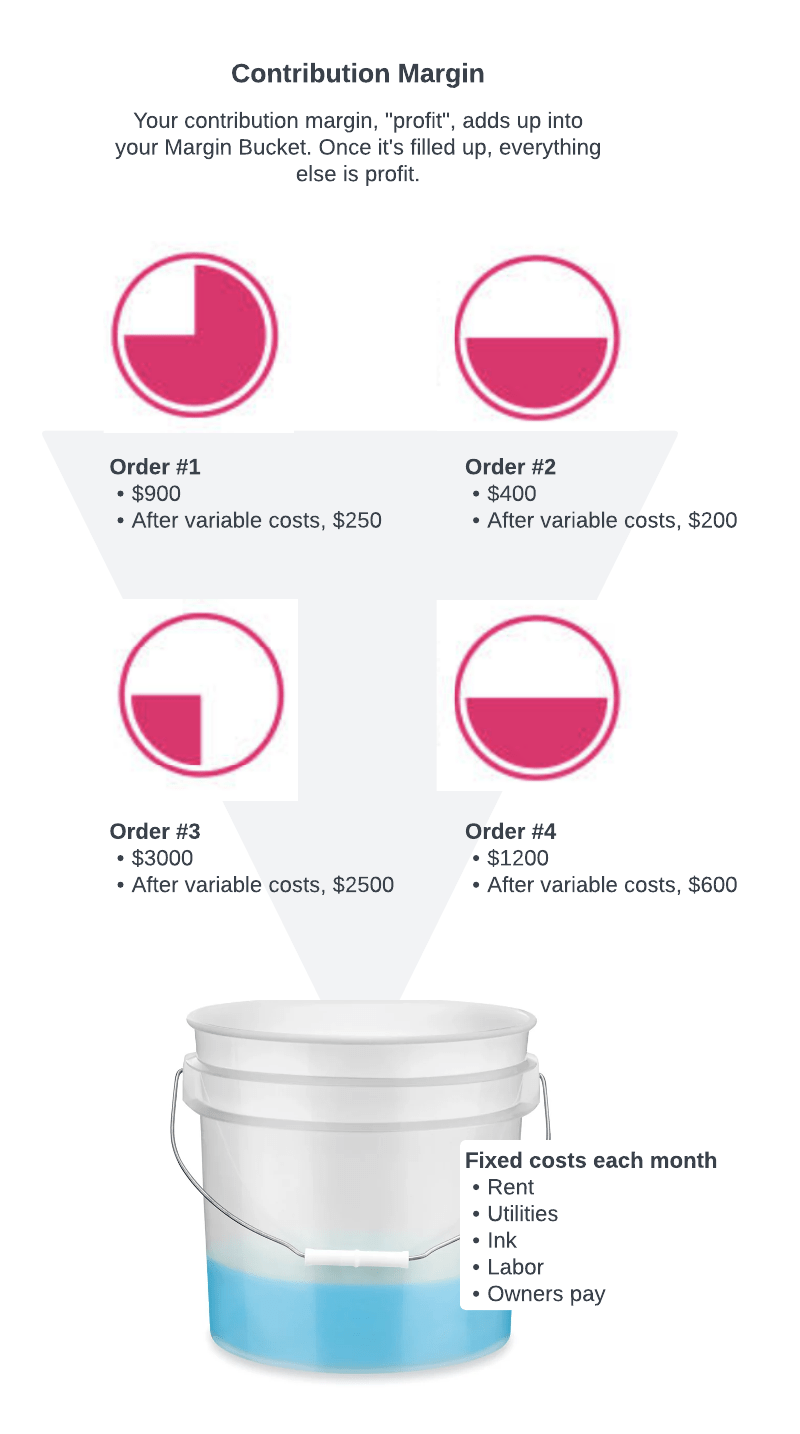

Using Contribution Margin to Understand Print Shop Prices

Contribution Margin = Total Sales – Variable Costs

For every order, you should calculate your contribution margin. You simply define variable costs as the price of whatever you’re printing on. Let’s say it’s t-shirts.

So you get a $1,000 order – that’s your Total Sales amount. The order is for 50 t-shirts at $20 per shirt. You pay $5 for each shirt, totalling $250 in Variable Costs.

Contribution Margin = $1,000 Total Sales – $250 Variable Costs = $750 Contribution Margin

So now you know the $1,000 order takes away $750 from your overall fixed cost goal of $70,000 per month.

Using Your Contribution Margin To Set Screen Printing Prices

This is where the less scientific element comes into play with pricing.

There’s a great segment in the podcast where Nick and Steven discuss how different shops model their pricing, and how wild this industry is when it comes to prices. It’s worth reading:

Steven said: “Shops try to model how fast their press can spin, how much it costs to coat a screen. They try to model out every single part of the process. And there will be like 10 different variables. But the problem is that your margin of error is increased with each thing you model. It ruins the accuracy of your math. A lot of the mistake is simply assuming that they can model everything accurately.”

Nick responded: “I tried to make a spreadsheet and I realized it was nuts! There’s a better way here. There’s not a one size fits all strategy. It depends on the business. You have to sell what you do for as much as the customer can pay. You are trying to maximize the contribution margin dollars. You will have some that will just pay. You will have some that will haggle. And you will have some bottom feeders. But squeeze out that contribution dollar.”

You have to be sensitive to what your business does well. “It can be dangerous because you can say any job you can sell above your t-shirt cost is good for the business – but if you get into that mindset, it can be too easy to say that we can discount further or every single job is good. It’s highly situational,” Nick explained.

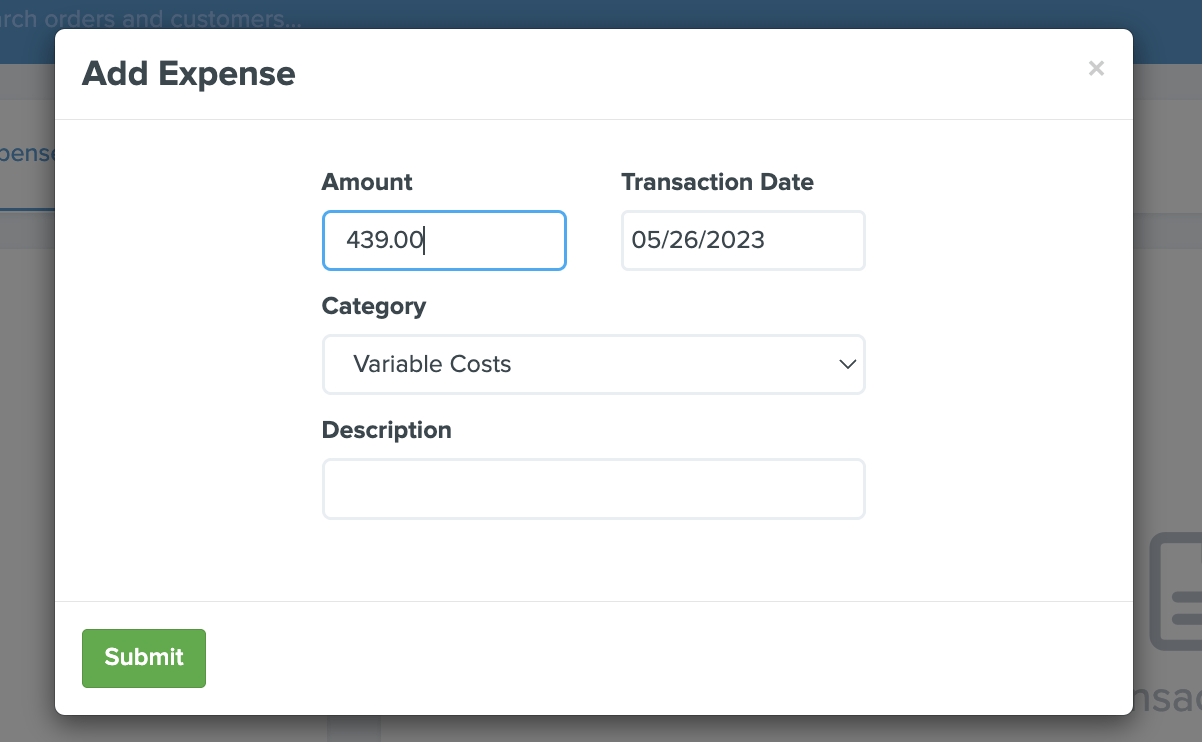

TIP: Use Expenses in Printavo. Steven said: “That’s how my sales team knows their contribution margin. We added our expenses in as COGS and they can track it that way. You can actually do this in Printavo, which is super cool. As you take your fixed costs and publish them to the team, you know 30% of every order is fixed costs. They know in their head that’s how it works and they can start doing things to meet those goals.”

Live Stream: June 27th, 2023 (And Free Slide Deck!)

We’re releasing the full version of our Print Shop Business Calculator after our live stream on June 27th.

For now, you can study this model and prepare by reading the slide deck we’ve prepared.

More info about the stream coming soon!

Summary

Fixed costs are expenses that do not change with the volume of sales. Examples include rent, insurance, and salaries.

Variable costs are expenses that change with the volume of sales. Examples include the cost of goods sold (t-shirts).

Contribution margin is the amount of revenue that is left over after variable costs are paid. This amount can be used to cover fixed costs and generate profit.

To calculate contribution margin, use the following formula:

Contribution Margin = Sales Revenue – Variable Costs

Once you know your contribution margin, you can use it to make decisions about pricing and production. For example, you may decide to lower your prices on certain products if they are generating a high contribution margin.

You can also use contribution margin to track your progress towards your financial goals. For example, if you know that you need to sell a certain number of units each month to cover your fixed costs, you can use contribution margin to track your progress towards that goal.

How To Learn More

Go down the rabbit hole and you will be very well equipped to take what we learned here and go further.

And reach out to Nick on LinkedIn!

0 Comments